MUMBAI: Axis Bank, Bandhan Bank, and Sammaan Capital have revised their accounting practices in the first quarter of this fiscal year suggesting a mixed approach to accounting prudence.

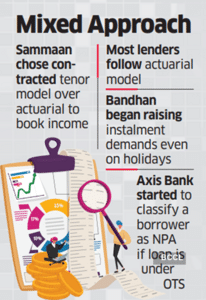

While Axis and Bandhan have adopted more conservative practices, Sammaan Capital, formerly known as Indiabulls Housing Finance, opted for an aggressive policy in booking income on securitised loans, which boosted its first-quarter profits.

The revised accounting policy helped Sammaan Capital's report ?661.6 crore gains. In contrast, Axis Bank, which tightened its policy, made additional provisioning of ?614 crore, impacting its earnings. Bandhan Bank implemented procedural changes in the collection of dues, which led to marginal rise in stressed loans, although it did not immediately impact its earnings.

Sammaan Capital

On its securitised pool amounting to ?20,229 crore sold and outstanding till June 30, Sammaan Capital discontinued the conservative accounting practice of booking upfront income based on an actuarial model. Instead, it adopted the contracted tenor model in the first quarter. Under the actuarial model, lenders book upfront income on securitised loans for seven to eight years, factoring in the probability of home loan prepayments. However, under the contracted model, a lender books income based on the actual tenor of the loan-typically 15 to 20 years.

Booking income over a longer tenure allows for a temporary boost in earnings, although most of these loans are eventually prepaid, leading to income reversals in future. Thus, most lenders follow the actuarial model.

The management told analysts last week that the revised policy has been approved by the board, adding that there could be "minor reductions" in income in subsequent quarters if prepayments occur.

They also said that revised co-lending norms prompted the change in accounting policy for securitised loans and that the upfront income was used to create one-time provisions.

The finance company reported a consolidated net profit of ?334 crore in the first quarter, up 2.4% over the corresponding period last year.

Sammaan Capital did not comment on ET's query.

Bandhan Bank

Starting April, Bandhan Bank began raising instalment demands even on holidays for its emerging entrepreneurs business (EEB) segment, regardless of whether collections were made that day. Previously, such demands were not raised on festival holidays, state holidays and Sundays. The EEB segment primarily comprises microfinance borrowers.

This procedural change led to a temporary increase in SMA-0 accounts (where payments are delayed by zero to 30 days), the management informed analysts after announcing results. The bank attributed the marginal decline in collection efficiency to the new holiday billing practice, rather than any deterioration in borrower behaviour.

Bandhan Bank's net profit fell 65% to ?370 crore in June quarter over corresponding period last year.

Axis Bank

Axis Bank revised its accounting policy, referring to the change as a "technical impact." The updated policy aligns with practices followed by peers and pertains to one-time settlements (OTS) of loans. Under the revised approach, if a borrower under OTS pays one instalment, the account will continue to be classified as an NPA until full repayment is made.

"We expect recoveries and upgrades to improve in H2FY26 as OTS repayments come in," Amitabh Chaudhry, MD & CEO, told analysts. Of the ?8,200 crore gross slippages, ?2,709 crore is due to technical slippages. The lender's net profit was down 4% to ?5,806 crore on a YoY basis.

It is unclear whether the changes at Axis Bank and Bandhan Bank were prompted by regulatory nudges because other larger banks have highlighted that they already follow these practices. Also, these changes were introduced after the IndusInd Bank episode that put the spotlight on accounting discrepancies.

Analysts said the aggressive accounting policy adopted by Sammaan may attract regulatory scrutiny prompting them to consider standardising policies on booking income on securitised loans, they said.

While Axis and Bandhan have adopted more conservative practices, Sammaan Capital, formerly known as Indiabulls Housing Finance, opted for an aggressive policy in booking income on securitised loans, which boosted its first-quarter profits.

The revised accounting policy helped Sammaan Capital's report ?661.6 crore gains. In contrast, Axis Bank, which tightened its policy, made additional provisioning of ?614 crore, impacting its earnings. Bandhan Bank implemented procedural changes in the collection of dues, which led to marginal rise in stressed loans, although it did not immediately impact its earnings.

Sammaan Capital

On its securitised pool amounting to ?20,229 crore sold and outstanding till June 30, Sammaan Capital discontinued the conservative accounting practice of booking upfront income based on an actuarial model. Instead, it adopted the contracted tenor model in the first quarter. Under the actuarial model, lenders book upfront income on securitised loans for seven to eight years, factoring in the probability of home loan prepayments. However, under the contracted model, a lender books income based on the actual tenor of the loan-typically 15 to 20 years.

Booking income over a longer tenure allows for a temporary boost in earnings, although most of these loans are eventually prepaid, leading to income reversals in future. Thus, most lenders follow the actuarial model.

The management told analysts last week that the revised policy has been approved by the board, adding that there could be "minor reductions" in income in subsequent quarters if prepayments occur.

They also said that revised co-lending norms prompted the change in accounting policy for securitised loans and that the upfront income was used to create one-time provisions.

The finance company reported a consolidated net profit of ?334 crore in the first quarter, up 2.4% over the corresponding period last year.

Sammaan Capital did not comment on ET's query.

Bandhan Bank

Starting April, Bandhan Bank began raising instalment demands even on holidays for its emerging entrepreneurs business (EEB) segment, regardless of whether collections were made that day. Previously, such demands were not raised on festival holidays, state holidays and Sundays. The EEB segment primarily comprises microfinance borrowers.

This procedural change led to a temporary increase in SMA-0 accounts (where payments are delayed by zero to 30 days), the management informed analysts after announcing results. The bank attributed the marginal decline in collection efficiency to the new holiday billing practice, rather than any deterioration in borrower behaviour.

Bandhan Bank's net profit fell 65% to ?370 crore in June quarter over corresponding period last year.

Axis Bank

Axis Bank revised its accounting policy, referring to the change as a "technical impact." The updated policy aligns with practices followed by peers and pertains to one-time settlements (OTS) of loans. Under the revised approach, if a borrower under OTS pays one instalment, the account will continue to be classified as an NPA until full repayment is made.

"We expect recoveries and upgrades to improve in H2FY26 as OTS repayments come in," Amitabh Chaudhry, MD & CEO, told analysts. Of the ?8,200 crore gross slippages, ?2,709 crore is due to technical slippages. The lender's net profit was down 4% to ?5,806 crore on a YoY basis.

It is unclear whether the changes at Axis Bank and Bandhan Bank were prompted by regulatory nudges because other larger banks have highlighted that they already follow these practices. Also, these changes were introduced after the IndusInd Bank episode that put the spotlight on accounting discrepancies.

Analysts said the aggressive accounting policy adopted by Sammaan may attract regulatory scrutiny prompting them to consider standardising policies on booking income on securitised loans, they said.

You may also like

Antiques Roadshow expert left stunned over 'show first' as he values item at £300k

Latest Odisha Breaking News Updates | Monday, 18 August 2025

Countryfile legend John Craven shares final wish in emotional plea

'Putin will not stop': Ex-US VP calls for additional sanctions on Russia; applauds Trump

Antiques Roadshow guest refuses to sell after priceless Titanic items valued